Before I answer this question let’s consider what will happen if we don’t.

We have various investment opportunities like.

1. Bank Fixed Deposits

2. Corporate Bonds

3. Government Securities like RBI Bonds, National Savings Certificates, Kisan Vikas Patra

4. Gold in the form of Gold Bonds, physical gold, Gold ETFs

5. Real Estate

After all, they are presumed to be much safer than Shares. Right?

But have you ever checked the long term returns of these asset classes over the years?

1. FIXED DEPOSITS

Historically the rates peaked at 8% in 2014-15, fell to 6% in 2016-2018 and to 4% in 2020-22. Presently they are again at 6% following rate hikes to reign in the inflation which is hovering around 6.77%.

Besides you pay tax on interest which further reduces your income and barely covers your increased expenses.

Money is subject to Time Value. Time decays the original amount of investment if the rate of income does not exceed inflation.

2. CORPORATE BONDS

They are debt issued by companies to raise capital. These securities are subject to two types of risk.

Credit Risk- This is the risk of default by company in paying interest and principal.

Interest Rate Risk- This risk arises when interest rate rises over time, while you are locked in lower rate.

While credit risk can be reduced by checking the Credit Rating of the securities, the best being the AAA rated, interest rate risk is high in a scenario of rising interest rates. Currently AAA rated bonds are available at 7.5% while AA is available at average of 8.5%. After deducting tax (let’s assume 20%), the net income reduces to 6% (7.5% less 20%). Is it enough to cover inflation @ 6.77%? No. Is it as safe as bank deposits? No since they are issued by corporates and are subject to credit risk and interest rate risk.

3. Government Bonds

They are high in safety but interest rates ranging between 9% in 2013 to 6% in 2016, 5.7% in 2020 and 7.3% presently. Tax free bonds save you from taxes but have lower interest rates and all bonds are subject to interest rate risk. Again rates hardly cover the inflation rate.

4. GOLD

Considered a safe investment. Right? But did you know prices of gold have fallen since its peak of Rs 65325 (Aug 2020) and Rs 65,992 (Mar 2022) to Rs 52304 (Oct 2022). Those who bought @Rs 65992 have witnessed 20% drop in price.

Historically Gold has given 8-9% in 5 to 7 years holding period which makes it a good inflation hedge. Due to negative or no correlation with equity it makes a good hedge in equity-heavy portfolios. Gold tends to perform best when other asset classes such as equity are under stress.

5. REAL ESTATE

The Reserve Bank of India’s House Price Index, which tracks home prices in 10 Indian cities, shows that return from owning housing real estate has plunged dramatically.

A bulk of the returns from over the last decade was earned between June 2010 and June 2015. Subsequently, between June 2015 and June 2020 returns have been at 5.5% per year. Rental yields are also low at 1% -2%.

BUT ISN’T THE STOCK MARKET RISKY AND VOLATILE?

Let’s check the chart of Nifty 50 for the past 10-15 years. In Jan 2013 Nifty 50 closed at 6034 pts and as on Jan 2023 it is at 17854. It has provided a rolling return of 14% in last 10 years and 11.6 % in last 5 years. Nifty saw major setbacks during 2016 for change in government, during demonetization and during COVID lockdown. However each time the bounce back was sharper.

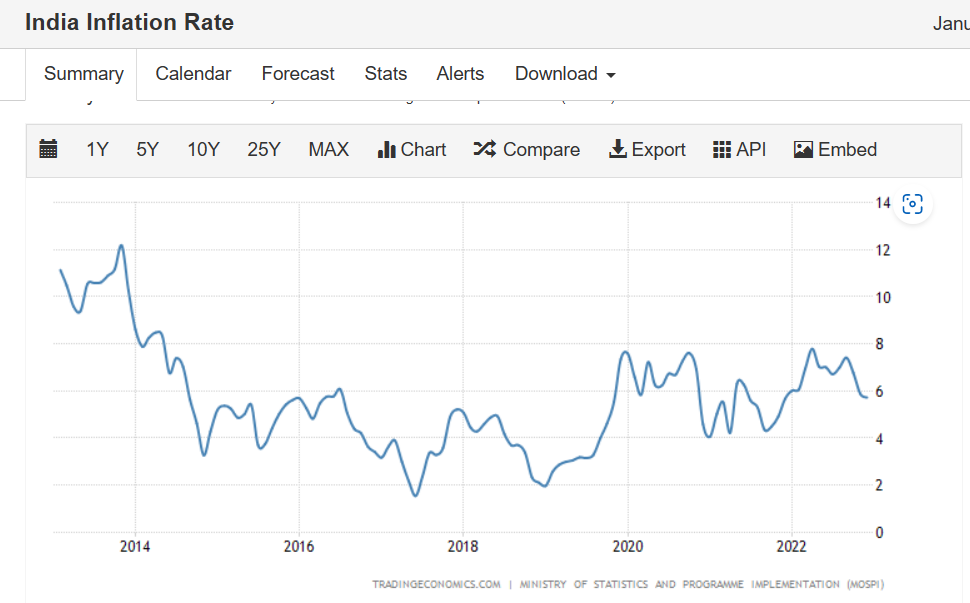

Inflation rate in India on the other hand was 12% in 2014 and is hovering between 8% on higher side to 4.5% on lower side. It is at 5.72% in December 2022.

Money is subject to Time Value. The amount of goods money could buy 10 years ago is much less than what it can buy today. In order to protect your investments from erosion in value it is necessary that your portfolio gives an after-tax return in excess of the inflation rate.

I shall now list down the benefits of stock investing.

1. Your investment grows as the economy grows– India is expected to grow at the rate of 6-6.5%. It is likely to become the third largest economy by 2030. Growth of the economy leads to more jobs and hence more purchasing power in hands of people. As people have more money to spend, demand rises and so does production. Growth in the manufacturing sector and service sector leads to growth in the businesses in which you are invested in.

2. Potential to earn higher returns

Nifty has given an average return of 12% for past 10 years. This is the average of the growth rate of all the companies comprising the index. The returns of individual companies are higher, and the prices rise when the companies deliver good quarterly results. Further the companies offer dividends and announce bonus and share splits which also increases the value of the shares over the long term.

3. Safety against inflation

Inflation erodes the purchasing power of money. Return on Investments should therefore always be more than inflation rates to protect the value of money. Moreover, interest is taxable and hence lowers the actual return further. The stock market gives a much higher return and not only protects the investment from erosion but also adds returns and makes it grow

4. Liquidity

The shares are listed on all major exchanges and provide liquidity. It can be easily converted to cash unlike other assets like real estate, tax-saving fixed deposit, public provident fund (PPF), etc., which are hard to convert into cash or have a pre-defined lock-in period, stock market investing scores high on the liquidity front.

5. Diversification

A good portfolio requires much needed diversification so that of one asset class fails to deliver returns, the other classes make up for the loss. Investing in only fixed deposits or real estate makes the portfolio risky and fails to deliver returns. Further within equities you can diversify as per your risk appetite into large caps, medium caps and small cap stocks.

A word of Caution

Investing in Equities is easy, but it also requires proper research and a long-term perspective of at least 5 years. Markets face short term volatility in terms of expansion, contraction and sideways movements. Prices of shares in the stock market are also highly sensitive to economic changes, changes in government policies and also changes in their own management and performance. Investment should be done only if you understand the sector, the business, the company management and also at a price which is less than its fair value. Only then you can benefit hugely in the long term.

DISCLAIMER

The information contained herein is generic in nature and is meant for educational purposes

only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product.