Several changes have been made in the Income Tax Rules by the Government with effect from April 2022 affecting our major investments and tax savings. Income tax on crypto assets, filing of updated returns, new tax rules on EPF interest, and tax relief on Covid-19 treatment are some of the major changes effective from 1 April 2022. In this article we shall discuss all these changes in detail.

1. Tax applicable on Provident Fund Interest:

Interest earned on contributions made by the employees in Employees’ Provident Fund (EPF) Account over and above Rs 250,000 per annum will be taxed. The EPF account will be divided into taxable and non-taxable contribution accounts. This new rule will only apply to the contributions made by the employee, while contributions made by the employer will not be taxed.

The taxable and non-taxable portions are as mentioned below

| Non-Taxable portion | Taxable portion |

| (i) closing balance in the account as on 31st March 2022 | |

| (ii) contribution made by the person in the account during the previous year 2022-2023 and subsequent previous years, which is not included in the taxable contribution account; | (i) contribution made by the person in a previous year in the account during the previous year 2022-2023 and subsequent previous years, which is in excess of the threshold limit of Rs 250,000 |

| (iii) interest accrued on sub- clause (i) and (ii) above | (iii) interest accrued on sub- clause (i) and (ii) above |

| Less Withdrawals from such account | Less Withdrawals from such account |

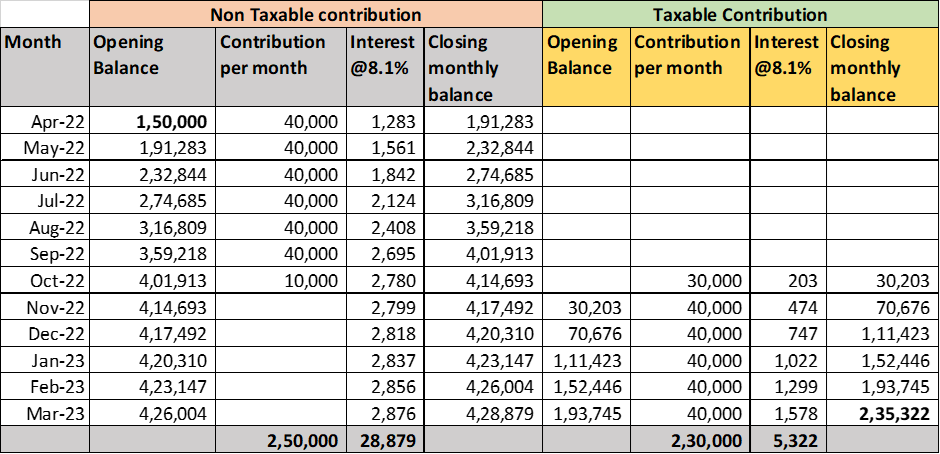

Let’s understand with an example.

Mr Sundar is contributing Rs 40,000 per month to his EPF Account. Hence his yearly contribution will be Rs 480,000. Hence Rs 230,000 (480000-250000) will be part of the Taxable portion. Interest earned during the year of Rs 5322 on this contribution will be taxed.

If he has an opening balance in EPF of Rs 150,000 as on 01/04/2022 the interest on this amount will be tax free. However, interest on the closing balance of Rs 235,322 in the Taxable Contribution part will be further taxed in subsequent years and interest on closing balance of Rs 428,879 in the Non-Taxable Contribution part will be Tax Free.

Who are impacted by this change?

1. Salaried people whose Employees contribution to Provident Fund is greater than Rs 2,50,000 per annum

2. Salaried people whose sum of Employees contribution and Voluntary contribution to Provident Fund is greater than Rs 2,50,000 per annum

2. New TDS Rules on Sale of House Property.

New Rule: TDS is to be deducted by buyer from money paid to seller or stamp duty value of the property whichever is higher. This is applicable if sale value or stamp duty value of house property is greater than Rs 50,00,000. TDS rate is 1%

Old Rule: TDS @1% was to be deducted by buyer from money paid to seller.

3. Additional Deduction for buying affordable house under Section 80EEA is removed

This was an additional benefit of Rs 1.5 lakhs available to first time home buyers of affordable houses (whose value was up to Rs 45 lakhs). This benefit was available over and above deduction for interest on housing loan under Section 24(b)

This benefit has now been removed. However, deduction of interest on housing loan is still available.

4. Higher TDS if Income Tax Return for FY 2020-21 is not filed

Who is affected?

A person who has not filed Return for previous two assessment years and time period for filing of return has expired AND aggregate of TDS and TCS is more than Rs 50,000 for each of the 2 years

Who is responsible? The person making the payment is responsible to check this before deducting TDS

Types of income on which it is applicable: Interest and Dividend Income

Types of Income on which it is not applicable

1. Section 192 (i.e. Salary),

2. Section 192A (i.e. Premature withdrawal of employees provident fund),

3. Section 194B (i.e. Winnings from lottery or crossword puzzle),

4. Section 194BB (i.e. Winnings from horse race.),

5. Section 194LBC (i.e. Income from investment in securitisation trust)

TDS rates would be HIGHER of the following

a) twice the rate specified in the relevant provision of the Act; or

b) twice the rate in force; or

c) at the rate of 5%.

5. Senior citizens aged 75 years & above exempted from filing ITR

Senior citizens aged 75 and above having only pension and interest income, will be exempted from filing their income tax return. Such persons should be Resident in India during the previous year. The paying Bank will deduct the necessary tax on their income.

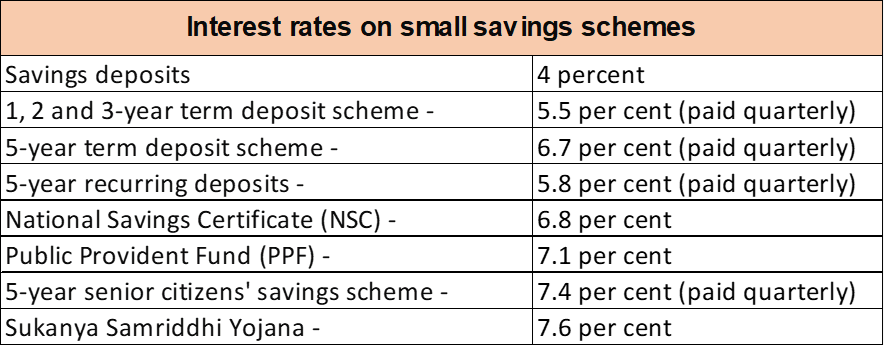

6. Interest Rates on Government securities remains unchanged for the first quarter of FY 2022-23

7. Tax on crypto and other virtual digital assets

1. Gains from virtual digital assets (VDA) such as bitcoin, dogecoin etc. will be taxed at a flat rate of 30%.

2. No deduction of any expenditure (except cost of acquisition) will be allowed.

3. The losses of buying /selling of VDA cannot be set off from other incomes.

4. Gains from one VDA cannot be used to set off losses from other VDAs.

8. Tax Relief on COVID Treatment and on ex-gratia received on death due to COVID

Amount on which Exemption is provided

1. amount received by a taxpayer for medical treatment from employer or from any other person for treatment of COVID-19 during FY 2019-20 and subsequent years.

2. money received by family members on death of a person due to COVID

will be exempt up to Rs.10 lakhs for family members

Courtesy: Economic Times, Taxguru.com, livemint