Why should you invest in Stock Markets?

How does investment in stock market compare with the other asset classes? Is it worth spending your time and money in the stock market? Find out the answers for yourself in this article. Read More

How does investment in stock market compare with the other asset classes? Is it worth spending your time and money in the stock market? Find out the answers for yourself in this article. Read More

We all search for leaders and successful investors from whom we can learn and grow. These leaders guide us in our investment journey as we try to find our way to financial freedom and achieve our financial goals.. Here is a list of 6 ace investors of Dalal Street. Read More

Making healthy investments is always important, and its more important now as the world grapples with rising inflation. Unfortunately, it is truly difficult to understand where to put your money and effort during times of economic uncertainty — but listening to experts can provide helpful insight. The greatest of all the experts Warren Buffett. has recently gave some important insights on what to invest in right now at the annual shareholder meeting of Berkshire Hathaway, his holding company. Read More

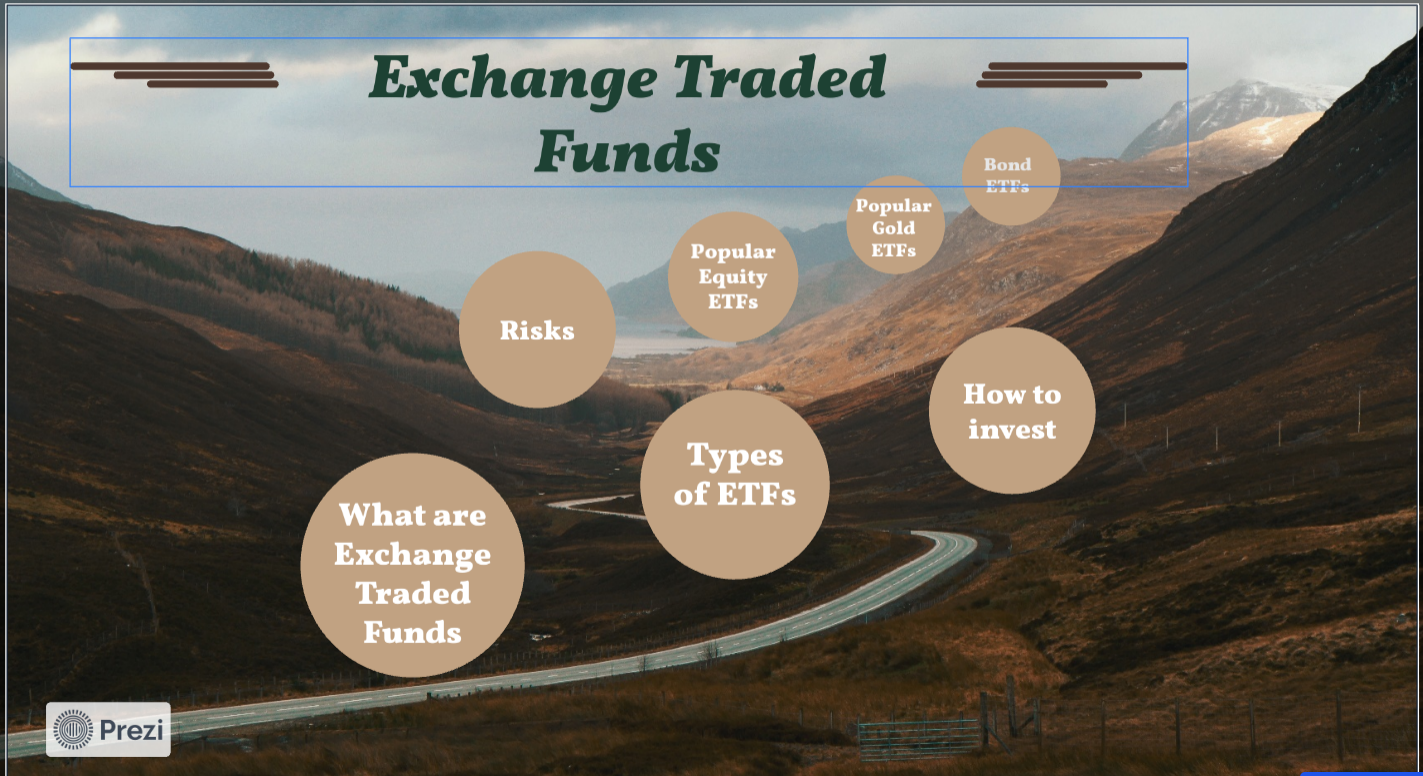

Exchange Traded Funds have become more popular as a source of investing into Equity nowadays. As compared to direct Equity investment and traditional Equity Mutual Funds they are more flexible, they can be traded in stock exchanges, have lower cost and offer greater flexibility. Lets examine how we can benefit from this type of investment Read More

Several changes have been made in the Income Tax Rules by the Government with effect from April 2022 affecting our major investments and tax savings. Income tax on crypto assets, filing of updated returns, new tax rules on EPF interest, and tax relief on Covid-19 treatment are some of the major changes effective from 1 April 2022. In this article we shall discuss all these changes in detail.

1. Tax applicable on Provident Fund Interest:

Interest earned on contributions made by the employees in Employees’ Provident Fund (EPF) Account over and above Rs 250,000 per annum will be taxed. The EPF account will be divided into taxable and non-taxable contribution accounts. This new rule will only apply to the contributions made by the employee, while contributions made by the employer will not be taxed. Read More

With Tax Saving season setting in many of us are now in a rush to complete our yearly tax saving routines. Equity Linked Savings Schemes (ELSS) are one of the most sought-after schemes for investing due to their lower lock in period of 3 years only. These funds invest their corpus primarily in equities (minimum Read More