Exchange Traded Funds have become more popular as a source of investing into Equity nowadays. As compared to direct Equity investment and traditional Equity Mutual Funds they are more flexible, they can be traded in stock exchanges, have lower cost and offer greater flexibility. Risk is more diversified in case of Exchange Traded Funds (ETFs) as compared to directly buying shares in the Stock Market. ETFs are not just limited to Equity, one can also invest in Debt ETFs, Gold ETFs, Sector specific ETFs and even International ETFs

As per statistics from National Stock Exchange the Assets under Management of all Exchange Traded Funds and Index Funds tracking Nifty 50 have crossed Rs 2 lakh crore. There was a record inflow of Rs 1.28 lakh crore in 2021-22 into the ETFs. Nifty 50 linked ETFs account for 40 per cent share of total AUM of ETFs and Index Funds in India.

In this article we shall explore what makes the ETFs so popular and check the various ETFs and the list of popular ETFs in India

What are Exchange Traded Funds (ETFs) ?

They are a basket of securities that track an index (NSE/ BSE) , commodity, bond, currency, debt securities and derive their value from the underlying securities. They can be traded in the Stock Exchange and are therefore more liquid than Mutual Funds. They often track indexes, such as the Nifty 50, BSE 100. Investors in these funds do not directly own the underlying investments, but instead, have an indirect claim and are entitled to a portion of the profits and residual value in case of fund liquidation. Their ownership shares or interest can be readily bought and sold in the secondary market.

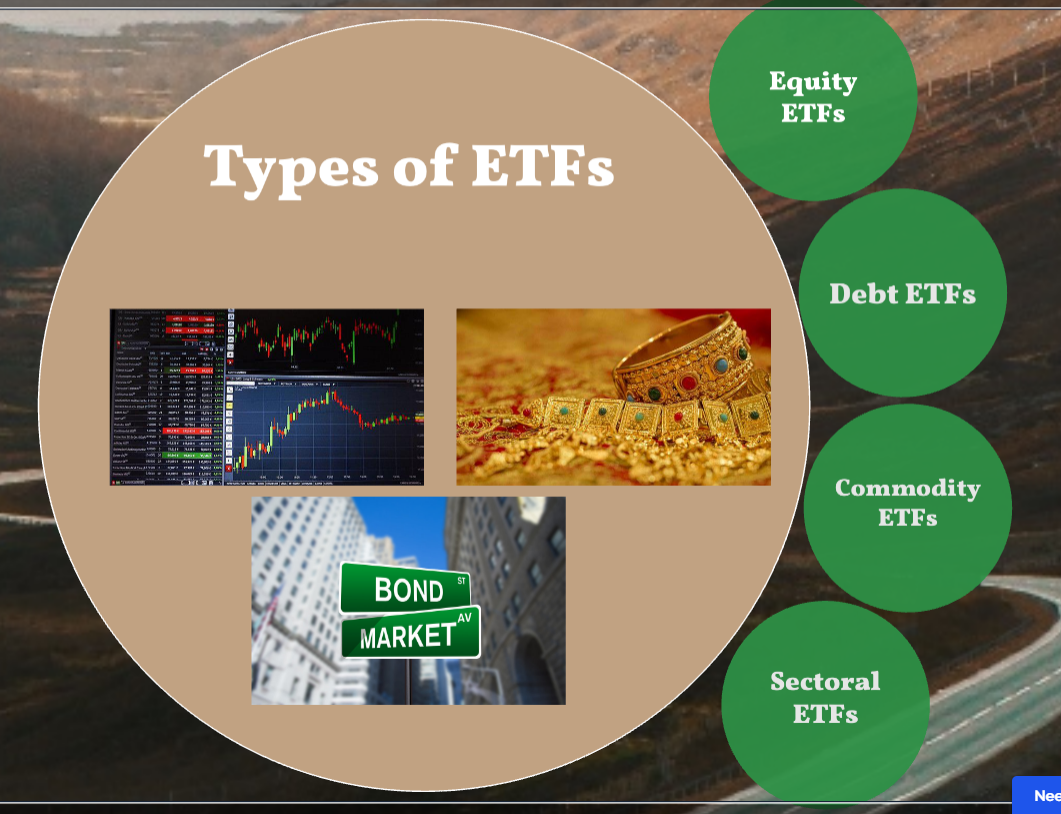

Different Types of ETFs

Common ETFs

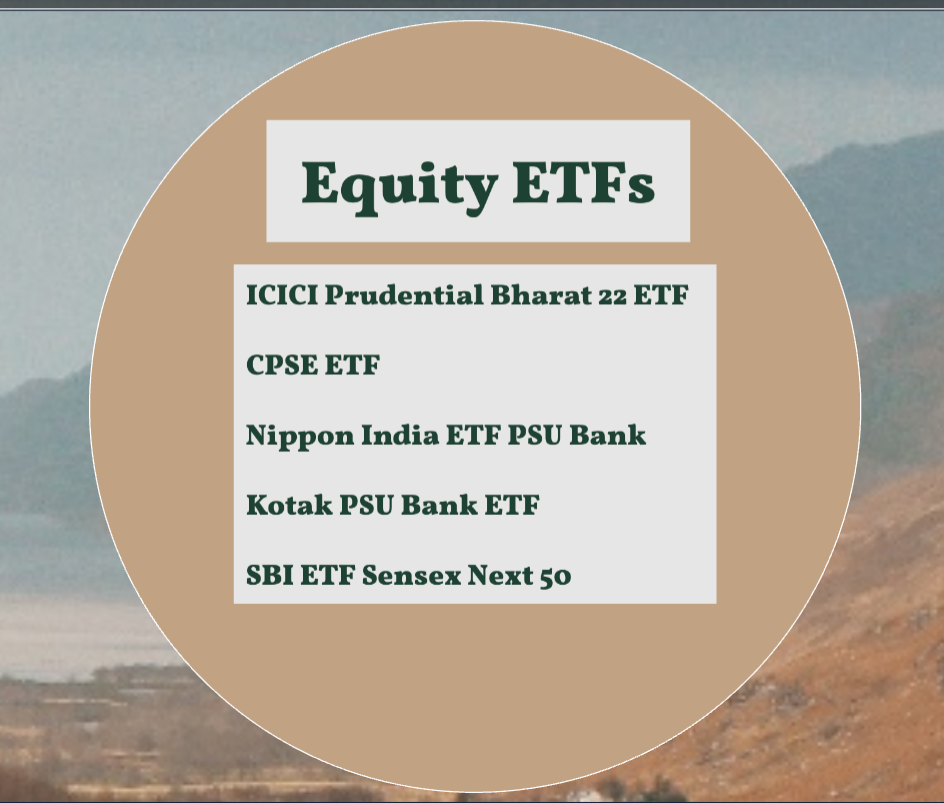

Equity ETF

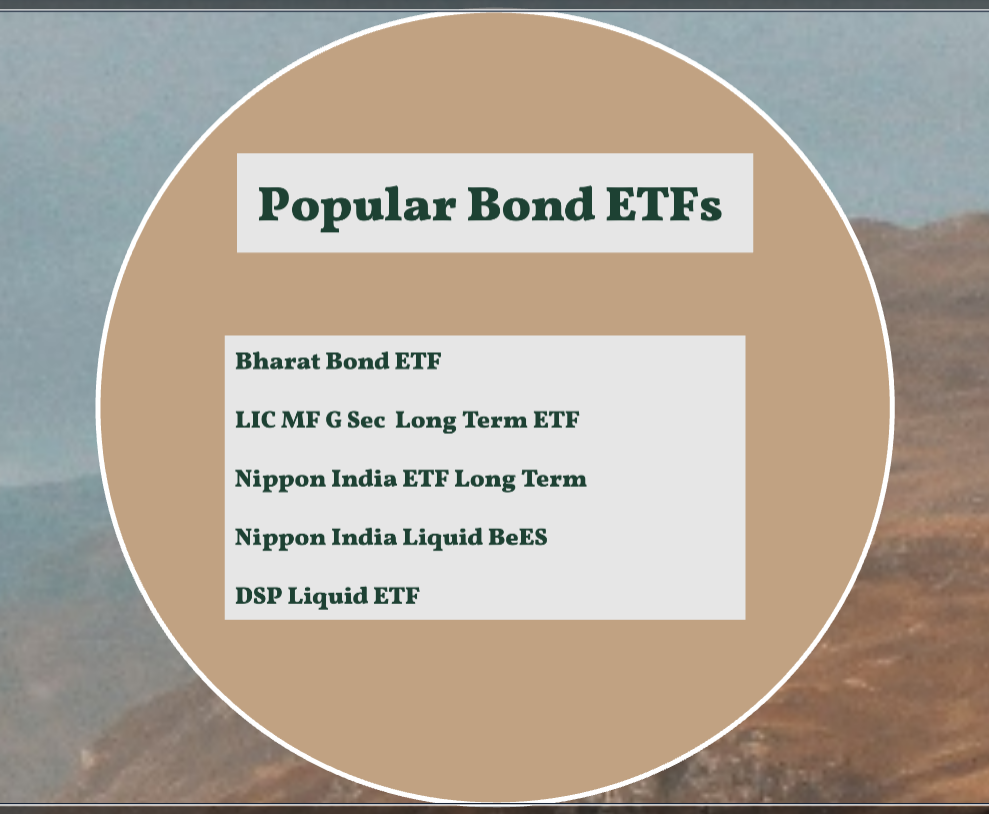

Debt ETF

Commodity ETF

Sectoral ETF

Other categories

Currency ETFs

International Equity ETFs

Risks Associated

Risk is diversified as investment in a basket of securities and expense is low.

Market Risk-

depends on a underlying equity stock or commodity

Tracking errors

ETFs may not exactly mimic the index performance

Trading Risks

Since it is held as stock investors may try to time the entry and exit and leave before desired return in earned

How to Invest?

- Each ETF is assigned a unique number and hence it can be bought and sold in same way as any shares in Stock market.

- Check the investment portfolio of the ETF and price changes Check credibility of the ETF provider AMC.

- If using an online broker platform you can find them listed with the shares.

- ETFs once bought are credited to demat account on T+3 days

Some Popular ETFs in India

ETFs have become popular because they have three attractive qualities: They are low-cost as compared to Mutual Funds, they offer tax efficiency, and they can be easily bought and sold. These funds have also become an alternative to mutual funds as they don’t require a minimum amount for investment.

Courtesy: Economic Times, Forbes India, Money Control, Scripbox