With Tax Saving season setting in many of us are now in a rush to complete our yearly tax saving routines. Equity Linked Savings Schemes (ELSS) are one of the most sought-after schemes for investing due to their lower lock in period of 3 years only. These funds invest their corpus primarily in equities (minimum 80% in equities and equity-related instruments).

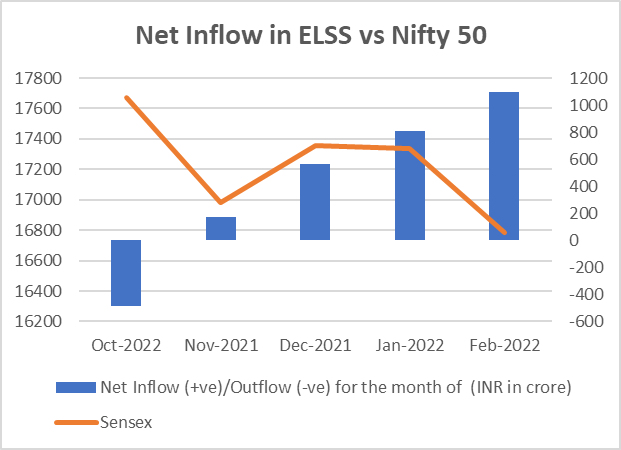

The February 2022 data as per AMFI website shows a marked increase in the net inflow into ELSS schemes from Rs 174 crores in November 2021 to Rs 1098 crores in February 2022. This despite a fall in Nifty from the highs of October 2022 at 18400 levels to the 17100 levels. This shows a rising confidence among retail investors in these ELSS schemes

However, as we scout for a reliable scheme, we come across 40 such schemes. Many of us depend on advice from agents and brokers or even our friends. What we see later is a loss on our investment due to faulty advice from brokers as they try to push funds providing them higher commissions.

In this article I will try to explain the factors you should consider while investing into ELSS.

1. Compare the Returns for a minimum 3-year period:

Since the time period of investment will be minimum 3 years, compare the returns over this period to get an idea of the consistency of returns, in any market condition. Avoid New Fund Offerings or funds in their initial year of existence as returns are not available unless the other factors are favorable

2. Portfolio of the Fund:

Though all ELSS schemes invest 80% in equities, the investment approach and asset composition are different. Some may invest largely in Mid Cap and Small Cap stocks making it riskier than others or some may invest heavily in some sectors and others may have a balanced portfolio. The selection would depend on your risk appetite.

3. The expense ratio of the fund:

The higher the expense ratio, the lower the net earnings. Expense ratio includes expenses like fund manager’s fees, register fees, distributor’s commission, advertising and auditing charges, etc. The expense ratio of an ELSS fund is usually up to 2.25% for equity funds. Also, investment in direct MFs have an advantage as expense ratio is lower as compared to investment done through brokers.

4. Fund manager and the reputation of the fund house:

The fund manager is the captain of the Fund and is responsible for steering the fund through turbulent waters. Hence the reputation of the Fund Manager is important. Also, the reputation, policies and experience of the Asset Management Company is important in taking a decision

5. Mode of Investment: Lump Sum or SIP:

During upward trends, the lump sum mode tends to give higher returns whereas during falling markets, investments made via a SIP generally provides better returns. SIP provides the benefit of averaging whereas lumpsum helps to time the market which is already in a slump and is likely to move up in future.

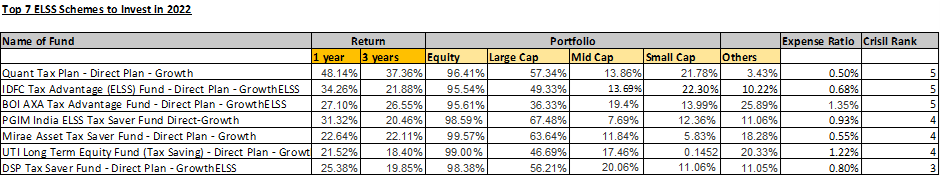

Here’s a list of the Top 7 ELSS Schemes to invest in 2022

In conclusion, though investment in ELSS is lucrative you must always begin your investment with your long-term goals in mind. There is no limit on the investment that you can make in an ELSS fund. You can also invest higher amount over and above the Rs 150,000 limit for Section 80C of Income Tax. It is also a good way to start investing in equity since it also helps you save taxes in the process

ELSS schemes have always been hot favourite among the tax payers.But how to choose the right one has always been a topic regarded as a black box .I definitely appreciate this blog where all the pros and cons have been mentioned in details.I would also like to mention about the cost factor that has been discussed here , in future will definitely keep in mind the cost factor before investing in any ELSS scheme.

In some ELSS schemes, there is a provisioning of SIP within lumpsum mode. Is it worthy for a retail investor?

In case of lumpsum SIP check the asset allocation of the fund where you are investing and ensure that it matches your risk profile, since large SIPs are riskier.

Comprehensive and lucid – will certainly help in taking calculated call than going by somebody elses advice – ELSS investment has now become Everything is Lucid and Seriously Simple

Very much useful information

I have gone thru the article and it seem to me very useful for the Income Tax Practitioner and also the finance people.

But as per my knowledge only the salary people who will interest for doing ELSS to them this content is not clear

But your effort is much appreciated and this subject matter is some how is to covered by giving some example

Thanks for sharing your feedback. Will surely try to add more examples

Very good post. I absolutely appreciate this website. Stick with it!

Thanks for your positive feedback. Your encouragement will help us serve you better.